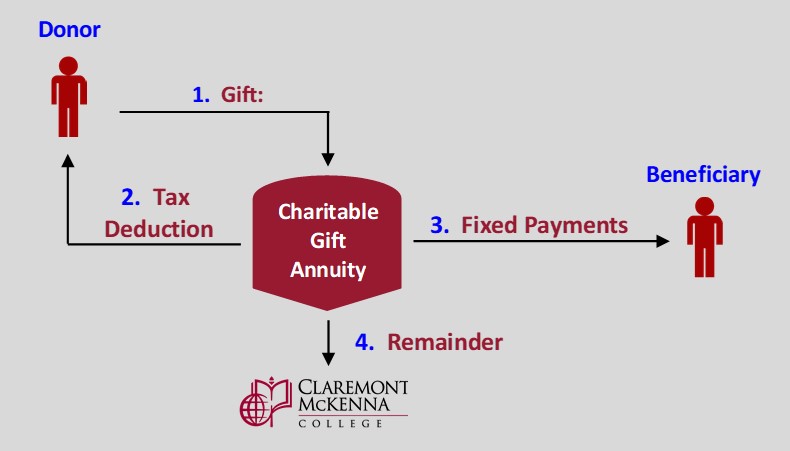

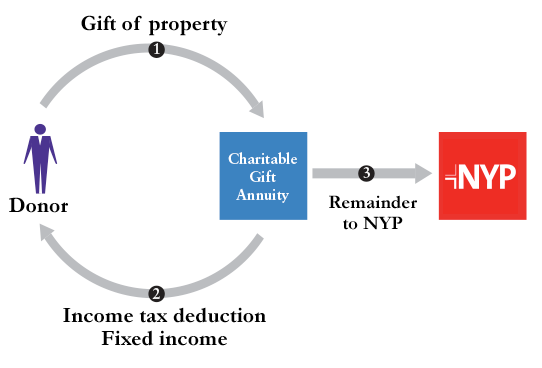

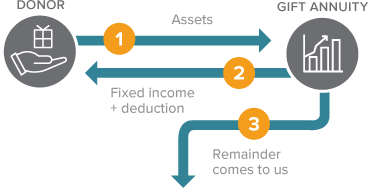

Gift Calculator Donor s Give assets Gift Annuity Income tax deduction Fixed payments. A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity.

Charitable Remainder Annuity Trusts Giving To Stanford

Our most recent analysis reveals that the ACGA rates exceed the maximum New York rates applicable to gift annuities funded in October December 2021 for females at ages.

. Payments may be much higher than your return on low-earning securities or CDs. Charitable Gift Annuity Charitable Remainder Trust Pooled Income Fund Charitable Lead Trust Disclaimer. If you are considering a gift annuity and live in New York State please contact your financial planner.

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Gift Annuity Calculator You can contribute cash or securities to Consumer Reports for a charitable gift annuity and in return receive fixed-rate lifetime annuity payments and a. Your actual benefits may vary.

Home Ways to Give Plan Your Legacy Giving That Provides Income Establishing a Deferred Charitable Gift Annuity Deferred Charitable Gift Annuity Calculator. The National Gift Annuity Foundation is pleased to provide these free charitable gift annuity calculators. Simply input the amount of your possible gift the basis of the property and the.

Payments may be much higher than your return on securities or CDs. How it Works 1. Ad True Investor Returns with No Risk Find Out How with Your Free Report Now.

Calculate Charitable annuity trust Receive fixed payments with tax free sale plus charitable tax deduction. New Look At Your Financial Strategy. Charitable Gift Annuity Calculator You can make a gift and receive guaranteed fixed payments for life.

Ad Annuities are often complex retirement investment products. Find a Dedicated Financial Advisor Now. Wills Trusts and Annuities Home Why Leave a Gift.

The older you are when you begin a gift annuity the higher your payment will be. Based on their ages they will receive a payment rate of 45 which means that. Learn some startling facts.

The amount of the charitable gift annuity is determined by the size of the donation and the donors age. Charitable Gift Annuity Calculator Take action for science-based decision making while earning an income from your gift. Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

Use this calculator to estimate the benefits you could enjoy with a CRS Charitable Gift Annuity plan. By gifting the 10000 to the Christian Church Foundation in return for a charitable gift annuity she could receive an income tax deduction of 499400 an annuity of 69 that would pay her. This calculator estimates the federal income tax deduction for a donor s based.

You make an irrevocable gift of cash securities or other property to Duke. Complete the form below to calculate your income for life and tax. The payment rate for joint gift annuities is lower than the rate.

For example a single person who is 70-years-old receives a payment rate of. In exchange Duke pays you a fixed amount each year for the rest of your life. Charitable gift annuities are a reliable and stable source of income.

Do Your Investments Align with Your Goals. In exchange the charity assumes a legal obligation. Charitable Gift Annuity Calculator Please click the button below to open the calculator.

Cultivating a Healthy School Culture. Calculate Deferred gift annuity Benefit from fixed payouts beginning at a date of. Use our handy Gift Calculator.

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Complimentary Planning Resources Are Just a Click. It provides a steady cash flow and can be.

Therefore these calculations are estimates of gift benefits. Visit The Official Edward Jones Site. Contact Mayo Clinic Office of Gift Planning at giftplanningmayoedu or 1-800-297-1185 for additional information on charitable gift annuities or to chat more about the personal.

For example if you created a 100000 gift annuity at age 70 you could expect to receive 4700 in payments each year. Current gift annuity rates are 49 for donors age 60 6 for donors age 70 and 77 for donors age 80. Calculate deductions tax savings and other benefitsinstantly.

Charitable Remainder Annuity Trust Calculator A great way to make a gift receive fixed payments and defer or eliminate gains tax. It depends entirely on your age. Gift Calculator Gift Calculator Use this free no-obligation tool to find the charitable gift thats right for you.

The American Council on Gift Annuities suggests the following payout rates for a single. Need help calculating expected income from a charitable gift annuity. Charitable Gift Annuity Calculator You can make a gift to NGAF and receive guaranteed fixed payments for life.

They fund a 25000 charitable gift annuity with appreciated stock that they originally purchased for 10000. Ways to Gift Meet Our Donors Tools.

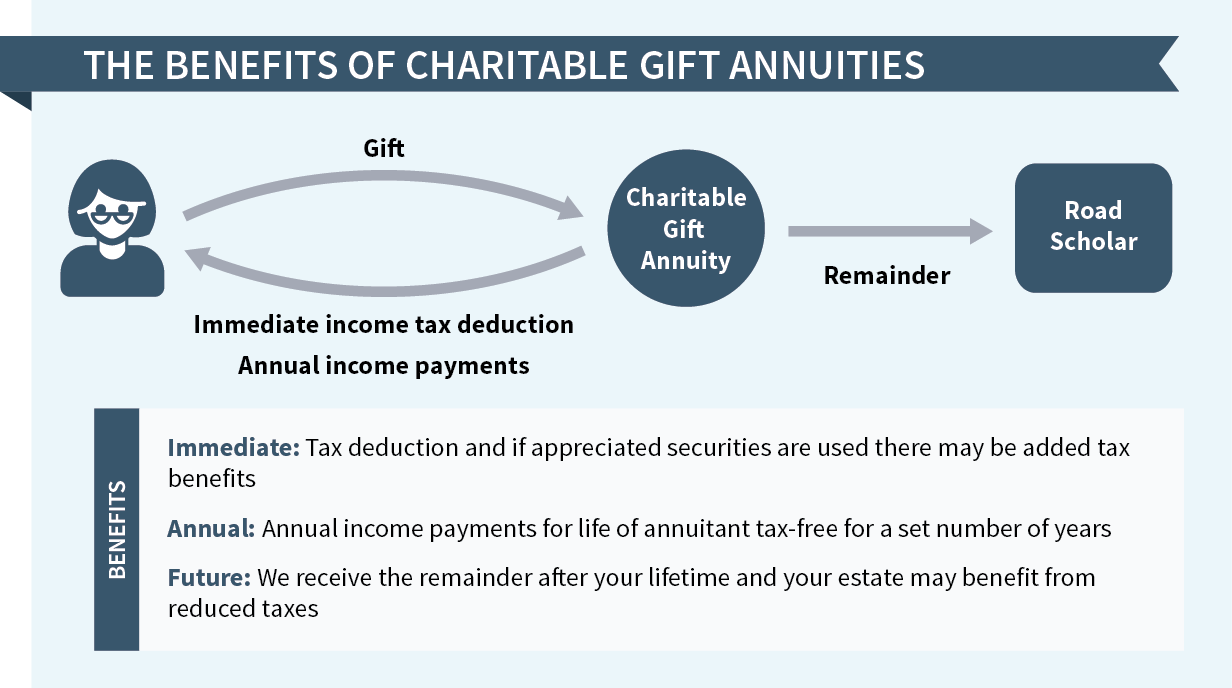

Charitable Gift Annuities Road Scholar

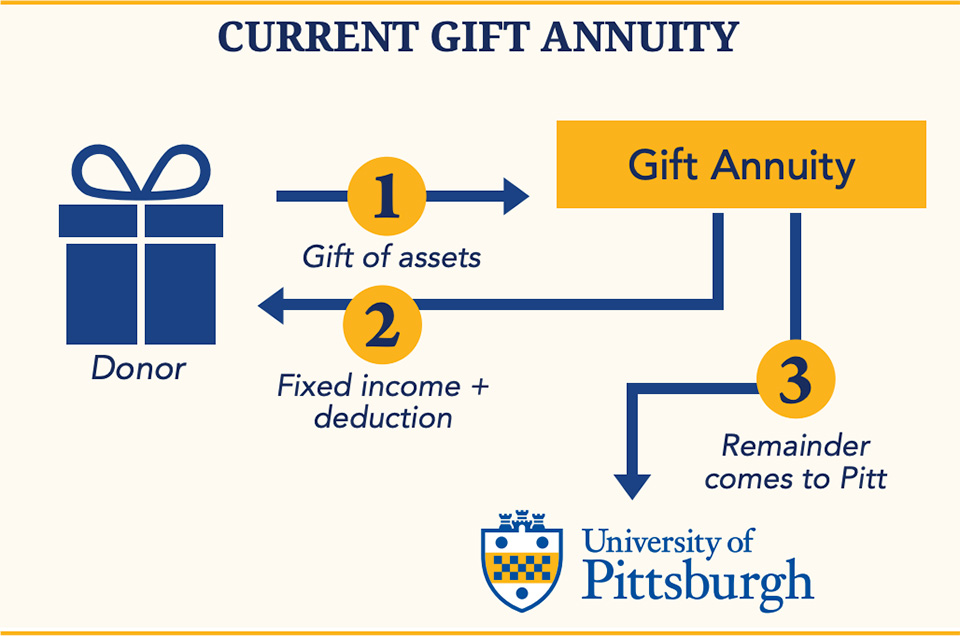

Charitable Gift Annuities The University Of Pittsburgh

Charitable Gift Annuities Giving To Duke

Turn Your Generosity Into Lifetime Income The Los Angeles Jewish Home

The Cmc Charitable Gift Annuity Claremont Mckenna College

Charitable Gift Annuities Kqed

Charitable Annuity Benefits Of A Charity Gift Annuity Link Charity

Charitable Gift Annuities Uses Selling Regulations

Planned Giving Calculator Harvard Alumni

Gifts That Provide Income Giving To Mit

Gifts That Pay You Income The Salvation Army Western Territory Arc

/charity_gift-5bfc2fa1c9e77c0026311fa6.jpg)

Retirement Tips Choose The Best Charitable Gift Annuity

Nyp Giving Planned Giving Gifts That Provide Income Charitable Gift Annuity Nyp

Charitable Gift Annuity Focus On The Family

Annuity Annuity Life Insurance Marketing Marketing Humor

Charitable Gift Annuity The Physicians Committee

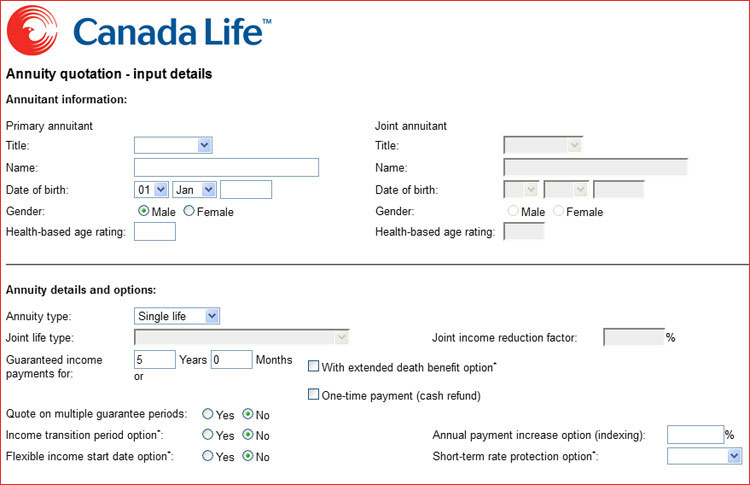

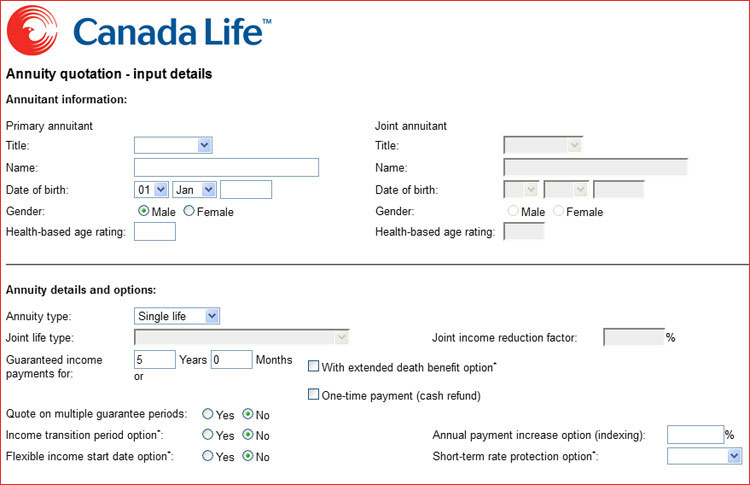

Canada Life Annuity Calculator Calculate A Canada Life Annuity Lifeannuities Com

Consumer Report Gift Annuity Calculator

Gifts That Pay You Income Fred Hutchinson Cancer Research Center